Which Countries Punch Well Above Their Population Size?

What do a Nordic archipelago, a South Pacific outpost, and a Scandinavian design hub have in common? With fewer than 6 million residents each, Iceland, New Zealand, and Denmark consistently outrank larger powers on global cultural stage—earning per-capita soft power scores that dwarf those of the U.S. and China. From Björk’s ethereal voice echoing through global playlists to Middle-earth’s cinematic landscapes drawing millions of tourists, these nations prove that population size doesn’t limit cultural reach.

In this comprehensive analysis, we’ll reveal the methodology—combining soft power indices, UNESCO heritage density, digital streaming metrics, and cultural export values—to identify the top 10 countries that truly punch above their weight in global cultural impact. You’ll explore case studies on Iceland’s musical rise, South Korea’s Hallyu wave, and New Zealand’s film-driven tourism boom, before diving into the strategic drivers and emerging players reshaping the soft power landscape. Ready to discover the world’s most surprising cultural heavyweights? Let’s dive in.

Defining “Punching Above Your Weight”

When a country’s cultural footprint exceeds what its population alone would predict, we say it is punching above its weight. To quantify this, we measure traditional cultural influence metrics on a per-capita basis:

- Normalized Soft Power Score: Soft Power 30 ranking divided by population (in millions) for a true per-person influence metric.

- Heritage Density: UNESCO World Heritage Sites per million residents, reflecting the concentration of cultural landmarks.

- Export Intensity: Value of cultural exports—film, music, publishing, cuisine—per inhabitant, highlighting trade strength relative to population.

- Digital Reach: Average streams or broadcasts per person on platforms like Spotify and Netflix, capturing modern media influence.

By benchmarking these indicators per capita, we spotlight nations whose cultural resonance far outstrips what raw population figures would suggest—revealing the ultimate small-but-mighty players on the global stage.

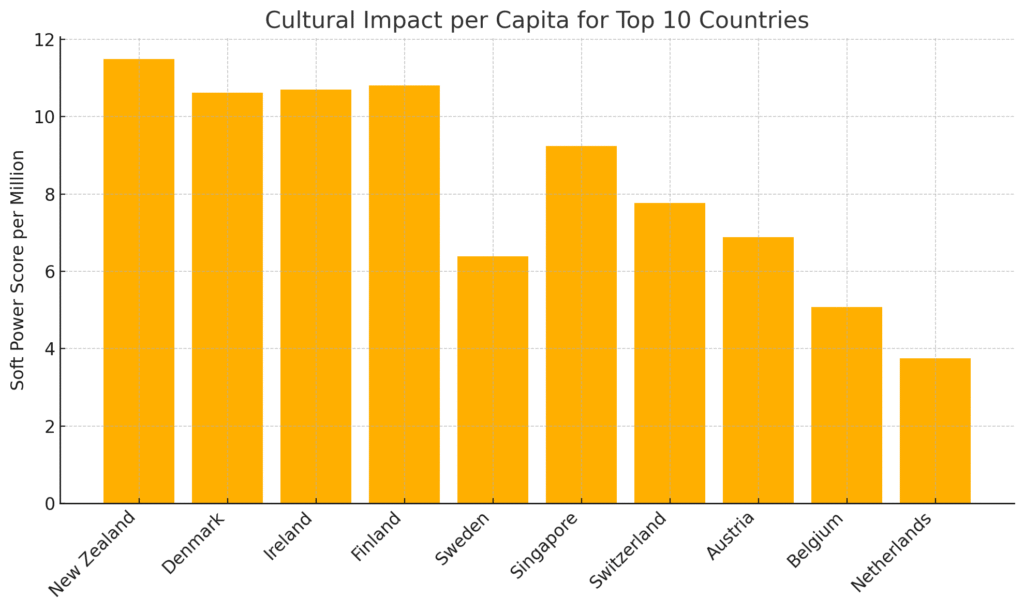

Top 10 Countries by Cultural Impact per Capita

Below is the ranking of countries delivering the highest cultural influence per million residents, based on our composite per-capita metrics.

| Rank | Country | Population (Millions) |

Soft Power Index Score |

Key Exports |

|---|---|---|---|---|

| 1 | New Zealand | 5.22 | 60.00 | Film (LotR), Music, Eco-tourism |

| 2 | Denmark | 5.95 | 63.20 | Design, TV (Borgen), Green Tech |

| 3 | Ireland | 5.20 | 55.61 | Literature, Music (U2), Pharma |

| 4 | Finland | 5.57 | 60.19 | Education, Gaming (Supercell), Design |

| 5 | Sweden | 10.40 | 66.49 | Music (ABBA), Furniture (IKEA), Start-ups |

| 6 | Singapore | 5.68 | 52.50 | Finance, Pharma, Media Hub |

| 7 | Switzerland | 8.70 | 67.52 | Watchmaking, Banking, Pharma |

| 8 | Austria | 9.00 | 62.00 | Classical Music, Tourism |

| 9 | Belgium | 11.60 | 58.85 | Comics, Beer, EU Institutions |

| 10 | Netherlands | 17.40 | 65.21 | Art, Trade, Horticulture |

Case Studies

Iceland’s Musical Tsunami

Step into Reykjavík’s vibrant music scene and you’ll quickly see why Iceland—home to just 370,000 people—commands over 8.7 million monthly Spotify streams across 96 countries, equating to about 23 streams per resident. From Björk’s avant-garde anthems to the ethereal soundscapes of Sigur Rós, this tiny nation punches well above its size. Strategic grants from the Icelandic Music Export Fund (€5M annually) and marquee events like Iceland Airwaves (50,000 international attendees) amplify local talent onto global platforms.

- Global Listeners: 8.7M monthly streams from 96 countries

- Festival Magnet: 50,000 tourists at Iceland Airwaves each year

- Export Grants: €5M in annual government funding fosters international tours

By combining visionary artists with savvy state support, Iceland transformed its music into a cultural export machine that belies its population.

South Korea’s Hallyu Wave

Imagine stadiums roaring as BTS unleashes a new anthem—an apt metaphor for South Korea’s meteoric cultural rise. With 21 Billboard Hot 100 entries and 4.7 billion YouTube views for “Dynamite,” K-pop dominates airwaves in over 200 markets. Meanwhile, Korean dramas have surpassed 90 titles on Netflix, captivating 180 million subscribers worldwide. Fueled by a ₩6.7 trillion government budget for Hallyu promotion and cutting-edge digital marketing, Korea’s soft power per capita rivals—and often exceeds—much larger nations.

- BTS Phenomenon: 21 Hot 100 hits; 4.7B YouTube views

- K-Dramas: 90+ titles on Netflix; 180M global viewers

- State Backing: ₩6.7 T invested in cultural exports

Through strategic fan engagement and immersive storytelling, South Korea recast pop culture as a national export powerhouse.

New Zealand’s Cinematic Tour de Force

When Peter Jackson’s Lord of the Rings trilogy premiered, it did more than win Oscars—it showcased New Zealand’s landscapes as fantastical realms, spurring 1.6 million additional tourists in its first year. With a 40% rebate on local production spending, the country lured blockbusters like Avatar, injecting $4 billion into the economy and creating over 8,000 film-related jobs. Today, guided “Hobbiton” tours and Weta Workshop experiences give every Kiwi a slice of cinematic fame.

- Tourism Surge: +1.6M visitors after LOTR release

- Incentive Model: 40% rebate attracts global studios

- Industry Impact: $4 B economic boost; 8,000+ jobs generated

By fusing imaginative storytelling with generous incentives, New Zealand turned its small population into the backdrop for global blockbusters.

Behind the Numbers: Soft Power Drivers

Unpacking why certain countries excel on a per-capita basis reveals a blend of policy, platforms, and people. Here’s what moves the needle:

- Strategic State Investment: Targeted grants and incentives—such as South Korea’s ₩6.7 trillion Hallyu fund or New Zealand’s 40% film rebate—fuel sector growth beyond domestic markets.

- Platform Leverage: Maximizing digital ecosystems: Spotify’s per-stream royalties and Netflix’s local-content quotas create global distribution with minimal population constraints.

- Heritage as Headliner: Nations with high UNESCO site density (e.g., Italy at 2.8 sites/million) convert cultural landmarks into tourism and soft power gold.

- Language & Education Outreach: French Alliance reaches 132 million learners globally, embedding cultural affinity through language courses and exchange programs.

- Diaspora Dynamics: Culinary, musical, and festival networks—think Nigerian Afrobeat clubs in London or Colombian salsa schools in Tokyo—turn migrant communities into cultural ambassadors.

Regional Highlights & Emerging Players

Beyond our top 10, dynamic regions and up-and-coming markets are staking new claims on the soft power map:

Latin America

- Colombia: Salsa rhythms and telenovela exports excite audiences from Miami to Madrid, backed by strategic streaming partnerships.

- Mexico: With a robust film industry and global culinary influence—tacos, mole, mezcal—Mexico punches above its 130 million population.

- Uruguay: Small literary prizes and boutique music labels fuel disproportionate cultural visibility.

- Norway: Gaming juggernauts (e.g., Supercell), high per-capita music earnings, and festival circuits in Bergen.

- Sweden: Pop hits (ABBA, Avicii), design exports (IKEA), and tech startups combine to create a diversified soft power portfolio.

Gulf & Middle East

- UAE: Expo 2020 Dubai pivoted into cultural programming, while Abu Dhabi’s Louvre and film festivals attract global attention.

- Qatar: Doha Tribeca Film Festival and Al Jazeera’s news reach bolster regional influence.

- Israel: Dubbed “Startup Nation,” Israel leverages Tel Aviv’s international film festival (DWIFF), UNESCO heritage sites in Jerusalem and Masada, and global exports of music (e.g., Idan Raichel Project) and cuisine (hummus, falafel) to extend its cultural footprint per capita.

- Saudi Arabia: Neom and Diriyah Season events signal a shift toward entertainment-led cultural strategy.

Africa & South Asia

- Nigeria: Nollywood churns out 2,500+ films annually, reaching diasporas across Europe and North America.

- India: Bollywood’s 1,000 films/year and diaspora festivals in London and Toronto sustain massive per-capita cultural ties.

- Kenya: Afrobeat and Benga music scenes gain traction through YouTube and diaspora-led events.

FAQ

How does Slovenia rank in cultural exports per capita?

Slovenia, with ~2.08 M people, scores 47.0 on the Soft Power Index—translating to ~22.6 per million. Key exports include literature and classical music festivals.

Which microstates appear when adjusting for population?

Microstates like Liechtenstein and Monaco lead in per-stream music payouts but often fall off Soft Power 30 due to survey sample sizes.

What’s the role of UNESCO sites per million?

Countries with >2 UNESCO sites per million (e.g., Italy, Luxembourg) gain tourism revenue and global prestige, boosting soft power metrics.

Why isn’t Japan higher per capita?

Japan’s large population (125 M) dilutes its strong absolute score (66.86). Per million, it ranks outside top 10 despite anime and cuisine exports.

What Did We Learn Today?

- Small populations ≠ small influence. Nations under 10 M can lead globally per capita.

- Soft Power Index per Capita reveals hidden cultural giants.

- Digital platforms are force multipliers—Spotify, Netflix, and streaming drive per-capita metrics.

- Government strategy and diaspora leveraging are key drivers.

- Future growth hinges on balancing authenticity with scalable outreach.